Utilizing payroll software program is a happy medium for self-employed people. You can enter your payroll info and it will deal with the self-employment tax calculations for you. Plus, you’ll be able to reap the advantages of full-service payroll software to deal with the tax funds for you. Maintain in mind that software can vary in pricing, so it’s essential to do your homework before deciding on a software program. Terms, situations, pricing, special options, and service and assist options subject to vary with out notice. QuickBooks Self-Employed is the only QuickBooks accounting product that doesn’t integrate with QuickBooks Payroll.

Setting up your organization profile is step one in utilizing QuickBooks Self-Employed. When you begin, you’ll need to enter your corporation name, address, and tax particulars. This data helps QuickBooks tailor its options to your needs. Nonetheless, you can even use a handbook model of QB Payroll, which is free to make use of. QuickBooks Self-Employed is designed for impartial https://www.quickbooks-payroll.org/ contractors, freelancers, and self-employed individuals.

- And QuickBooks Payroll lacks some key HR options, so if you’ll like extra worker advantages and in-house insurance brokers, you’ll get more bang on your buck with Gusto or Paychex.

- Find every little thing you need from employee benefits to hiring and management tools.

- However before conducting enterprise as a sole proprietor, there are a couple of unique tax twists and turns you should know about.

- If you’re calculating self-employment tax by hand, ensure to double (and triple) examine your calculations to avoid payroll problems down the street.

Equally, you can’t log the hours spent on a project and switch them over to the bill for quick pricing. You can’t even send quotes or estimates or schedule computerized late fees. Meanwhile, FreshBooks has the same beginning worth as QuickBooks Self-Employed—but it does all the above invoicing tasks after which some. QuickBooks’ invoicing capabilities are significantly lacking—which is a large issue for a freelance-focused product. You can send invoices, but you can’t customize them, set recurring invoices, or schedule automatic late cost reminders.

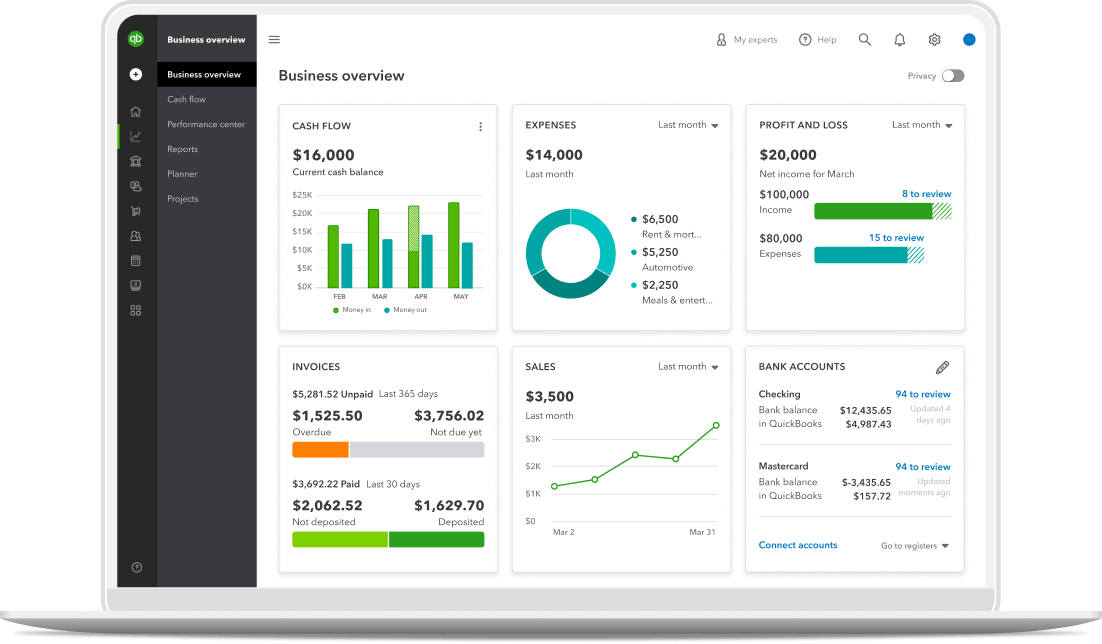

QuickBooks Payroll now includes team administration instruments so you’ll be able to streamline your HR tasks and save valuable time. From importing and sharing documents to requesting e-signature and automating l-9 compliance, do all of it from one easy-to-use platform. Discover every little thing you need from worker advantages to hiring and management instruments. Digital instruments like QuickBooks exist to help small enterprise house owners such as you save time — so you’ll be able to quickbooks self employed payroll turn more of your minutes into dollars. Both QuickBooks Online and QuickBooks Payroll are owned and distributed by the same company, Intuit, which additionally owns TurboTax.

This contains wage or hourly wages, private info, and tax submitting standing. An worker incomes a bi-weekly salary of $60,000 yearly will be topic to distinct payroll calculations compared to an hourly worker. It aids in the reconciliation of financial institution accounts, the monitoring of revenue and bills, and the era of financial reports. S corp homeowners who perform extra than simply minor work for their enterprise must earn a salary, which means they have to run payroll. Small business payroll software program is usually the most suitable choice as a result of it automates the method, saving time and serving to forestall costly errors.

And, you don’t have to worry about dealing with self-employment tax deposits. Doing payroll by hand is a cheaper alternative than outsourcing payroll or utilizing payroll software. However, doing payroll manually additionally means calculating self-employment tax by hand. If you’re calculating self-employment tax by hand, make sure to double (and triple) verify your calculations to keep away from payroll problems down the road.

Sole Proprietor

The starting worth for QuickBooks Self-Employed is $20 per thirty days, however there are promotional rates that may decrease this value for the first few months. In abstract, QuickBooks Self-Employed supplies important tools for managing bills and mileage, making it probably the greatest expense monitoring apps for self-employed people in 2024. Users can efficiently capture receipts, categorize expenses, and observe mileage, all in one place. QuickBooks Self-Employed makes it simple to keep observe of bills and mileage, guaranteeing users are prepared for tax season.

Like all QuickBooks merchandise (at least, all of its cloud-based accounting products), QuickBooks Self-Employed additionally wins massive for consumer friendliness. And the software’s studying curve is low sufficient that you must shortly get the grasp of importing bank transactions and sending invoices. All you can do with QuickBooks Self-Employed is ship a bland invoice with on-line cost options, and you’ll pay $15 a month for the pleasure. If sending primary invoices is all you need, we can recommend loads of cheaper choices. Nonetheless, you have to divide your bills between business and private use, after which only deduct bills associated to the business use of your vehicle.

Payroll Reports

Wanting at these steps, one would possibly assume that enterprise house owners who don’t earn a wage can escape payroll taxes, but that’s not the case. It is intended for one-person companies seeking to arrange and grow their business. It provides simpler setup, an improved transaction management expertise, together with added flexibility and productivity tools. But should you pay workers in a number of states, a QuickBooks competitor like Gusto with free multi-state payroll will cost much less in the long term. And QuickBooks Payroll lacks some key HR features, so if you want extra worker advantages and in-house insurance brokers, you’ll get more bang in your buck with Gusto or Paychex.

In distinction, QuickBooks Self-Employed is focused on primary bookkeeping for freelancers and others who file their taxes as sole proprietors. Since it was constructed for people who attach Schedule C types to their earnings tax varieties, its quarterly tax estimation, mileage tracking, and built-in tax optimization are extremely thorough. QuickBooks Self-Employed also offers you fundamental monetary monitoring instruments, similar to simple income monitoring and end-of-year profit and loss assessments. However, if you’re in search of a streamlined bookkeeping answer with excellent quarterly tax estimation features and mileage monitoring, QuickBooks Self-Employed is an efficient possibility.

Quickbooks Self-employed Vs Quickbooks On-line Faq

No, the 60/40 rule isn’t an official IRS guideline, but it’s a common rule of thumb utilized by many accountants and CPAs. It means that an inexpensive compensation cut up is roughly 60% of your net enterprise earnings as W-2 wage and 40% as a tax-advantaged distribution. The IRS looks at elements like your experience and business market rate to determine reasonableness, not only a formulation.